I have a question. Have you ever made a quick trip to the store for a few things and ended up spending way more than you planned? Or, set out to buy someone a gift and pick up something nice for yourself. I bet you have. We all have.

I have a weakness for Costco. My planned quick stop for smoothie ingredients would often become an hour-long and expensive exploration of every inch of the store.

They redesigned the store each week. They know that my search for frozen fruit will lead to impulse buys of unnecessary stuff.

I’ve improved, but it’s difficult to pass up a one-of-a-kind, discounted, must-have end-of-season winter jacket, knowing it may never be available again.

Yes, Costco understands my spending habits and uses them to influence my purchasing decisions from the moment I walk in. They prime me with multiple mailings, targeted social media posts, and emails before my monthly shopping trip.

There’s hope.

I’m a big believer in lists; they save me a fortune. Costco’s $1.50 hot dog with a drink is now off my lunch menu; I can’t afford it (not the hot dog, but everything on sale).

It’s common for all retailers to do this across their stores, websites, social media, and emails. It’s almost impossible to escape in the modern economy.

Here’s the question: Why did this assault on my bank account happen? I’m human, just like you. When I shop, my impulsive side overrides my rational side.

I can prove it with receipts. To make matters worse, my emotions justify my spending, numbing the pain.

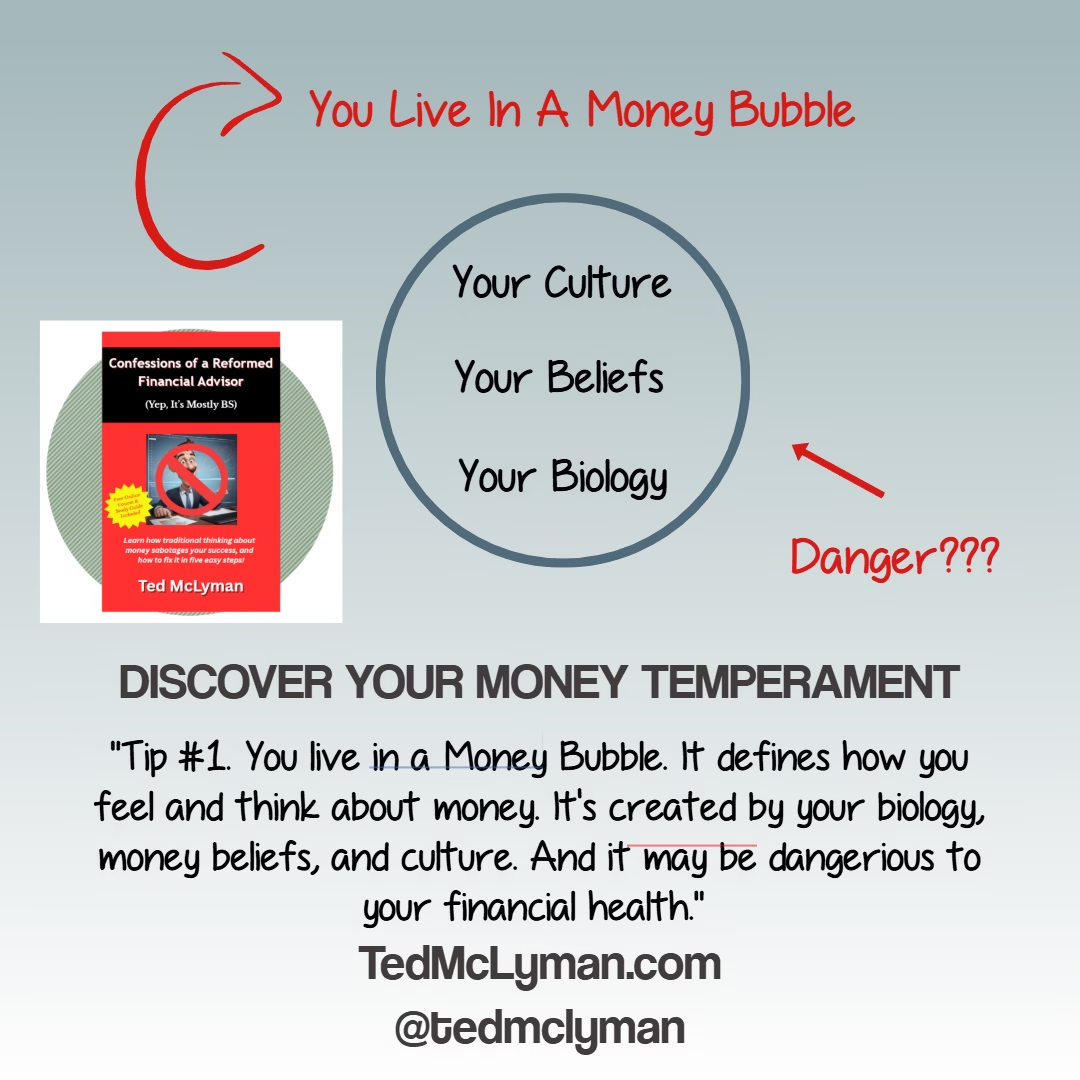

From my work, I’ve learned that humans aren’t naturally good at managing money. In this simple book (no charts, jargon, or product plugs), I explain why common money beliefs are false and why they hurt your finances.

I’ll share the insights I gained about the connection between people and money during my journey of building and selling Apexx Behavioral Financial Group. I will explain why humans struggle with finances and present my Money Behavior System to guide you toward better financial decisions.

Today, I work alongside my co-founders at DreamSmart Behavioral Solutions, assisting clients in defining, analyzing, and leveraging their inherent behaviors and money temperament.

This isn't a book on personal finance or investing—you can find that information anywhere. I wrote it for people who skip these books, but they shouldn't. It's a book that should've been on your school reading list. Surprisingly, this isn't something many financial experts know about.

Finally, hearty congratulations to the financially savvy who have not only mastered their finances but also secured their bright future, free from financial worries! Sadly, you're an exception to the norm. For most, managing finances is a continuous uphill battle, characterized by tight budgets, unexpected expenses, and insufficient income. Please share the information in this book with them.

How to Get the Most Out of the Book

- Register for the Introduction to the Money Behavior System video course at tedmclyman.com (the course, with 100% discount code, is included with the purchase of the book).

- Download and then print the book's study guide. It's in the course introduction's resources section.

- Complete the course and then read the book and do the exercises, with help from the study guide.

- Take part in the Behavioral Financial Wellness community. You register when you register for the course.

- Review the book, your study guide, and notes at least once a week for four weeks.

- Review the book, your study guide, and notes before any significant spending.

- Share what you've learned.