Get in touch

Do you have a question or a comment? Maybe you'd like information on booking Ted for your next event, podcast, or interview?

Email: ted@tedmclyman.com

"I used to be a traditional financial advisor. I’ll be honest: it was mostly BS. Traditional finance treats us like robots, assuming we're all identical. That’s why I quit.

Here's an important story. It will help you understand what I do.

If you asked me to teach you how to drive, I could give you tech manuals and YouTube videos and refer you to social media gurus. Then they ask you to pass a short online exam, and if you score at least 70%, issue your license.

Instead, I could start with a critical question and use your answer to create a personalized plan that helps you avoid accidents while driving.

My purpose is to help you find, uncover, and use your natural driving talents. I accomplish this by building a customized plan to guide you toward safer driving behavior.

The truth is simple: Biology drives your bank account. We aren't robots; we are emotional creatures with a unique 'Money Temperament'—our Financial DNA."

Your Money Temperament is like a financial fingerprint, specific to you. You can no more force yourself to stick to a budget that clashes with your personality than you can change the color of your eyes. You can't change who you are; so you need a system that fits you.

Your Path to Peace of Mind: Step 1: Uncover your Values. Step 2: Map your Temperament. Step 3: Know your learning style. Step 4: Automate your Strategy. Step 5: Execute your plan

I help people learn to "drive" their finances, rather than create a "bank."

There's a difference!"

We caught up with the brilliant and insightful Ted McLyman a few weeks ago and have shared our conversation below.

Ted, we're thrilled to have you on our platform, and we think there is so much folks can learn from you. Something that matters deeply to us is living a life and leading a career filled with purpose, and so let's start by chatting about how you found your purpose.

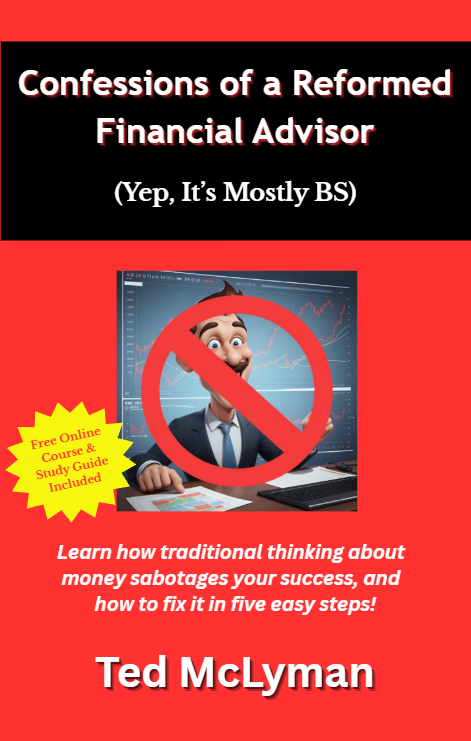

Finally, here’s the perfect book for people who avoid personal finance books but shouldn’t. It focuses on money habits and behavior rather than on the money itself. It guides you through discovering your money values, temperament, and learning style. And then, how to create your personal values-based and behavior-driven money strategy and plan. This should have been part of your school reading list. Surprisingly, this isn't something many financial experts know about.

5 STARS

Conventional wisdom about money is wrong. How you behave with money is more important than what you know. - Ted McLyman

I've spent years working with people and money, sharing my passion for economics as a teacher, thriving as a financial advisor, and even building and selling my own behavioral Registered Independent Advisor business.

I now focus on guiding exceptional individuals like you to uncover and master your money temperament through my straightforward Money Behavior System. Let’s join forces to transform the management of your finances into a behavioral journey instead of merely buying products and services and mindlessly chasing performance.

This book is for everyone, especially those who have never explored personal finance but should. It’s an easy read without numbers, graphs, or product recommendations. It explains why the concept of money temperament is often absent from most money and personal finance books.

This book should be on every school's reading list. It focuses on money behavior rather than money itself, revealing the flaws in traditional thinking about finance, investing, and planning. It's essential for anyone who deals with money, especially those who typically avoid such books, but should give them a chance.

We aren't naturally skilled at managing money. Our brains developed primarily for survival, which is why tasks like filing taxes, sticking to a budget, and planning for the future can be so challenging for many individuals.

The book is an easy read, free of complicated numbers, graphs, and product recommendations. It introduces the often-overlooked concept of money temperament in personal finance.

In Part 1, Ted McLyman explains why humans struggle with money and make poor financial decisions. Part 2 outlines the five simple steps of his revolutionary Money Behavior System. He offers practical examples and insightful tips to help you create a roadmap to financial security. You'll find that traditional financial planning often misses crucial initial elements—Steps 1, 2, and 3—while you may wonder why others seem to start at Step 5.

Drawing on his years of experience with people and money, Ted challenges conventional thinking about money, which he believes is ineffective. He shares the insights that transformed his understanding of financial security. This essential book is a must-read for anyone seeking to improve their relationship with money and make informed financial decisions.

Money is the common denominator in modern society. It's the fuel that drives the economy. Traditional thinking about money, financial planning, investing, and personal finance may be technically correct, but it might not be suitable for your money temperament. You need to know why and how to fix it.

Uncovering, discovering, and unleashing your natural money temperament is the key to financial success and peace of mind.

Who needs this book?

Table of content

Forward

Introduction

Chapter 1. I Confess...

Chapter 2. Humans Are Not Hardwired to Work Well With Money

Chapter 3. Your Money Beliefs and Values

Chapter 4. Technology Is Not (Always) Your Friend

Chapter 5. Your Money Values

Chapter 6. Your Money Temperament

Chapter 7. Your Money Knowledge

Chapter 8. Your Money Strategy

Chapter 9. Your Money Plan

Appendix

"If spending smart were just about willpower, you’d be rich by now. The financial industry treats you like a robot, assuming you’ll always make the logical choice. But as you know, a "Sale" sign can defeat a logical plan in seconds.

I used to be a financial advisor, but not anymore. I stopped pushing people into one-size-fits-all plans. I created a system that uses behavioral science to make smart spending easier. Now, that's what I do.

Before becoming a 'Reformed Financial Advisor,' I served as a US Marine Corps Lieutenant Colonel and an Economics Instructor at the U.S. Naval Academy. My experience spans from combat zones (Desert Storm, Urgent Fury) to the boardroom, where I served as Aide to the Assistant Secretary of the Navy for Financial Management.

Post-service, I managed money as a Registered Investment Advisor (RIA), founded Apexx Behavioral Financial Group, and co-founded DreamSmart Behavioral Solutions. I hold degrees from Colgate (BS), Boise State (MS), and Pepperdine (MPA), and have published five books on spending smart."

A Financial Choice Architect is a professional (often with a financial planning, consulting, or product design background) who applies the principles of behavioral economics to help people make better financial decisions.

The term comes from the concept of "Choice Architecture" popularized by Richard Thaler and Cass Sunstein in their book Nudge. The central idea is that the way choices are presented (the "architecture") inevitably influences the decisions people make.

I use my Money Behavior System to design the "environment" of decision-making to reduce friction and improve financial outcomes.

Email: ted@tedmclyman.com